Health Insurance

Invest in your Health

Your health is your most valuable asset—an asset so critical that without it, we are unable to enjoy the fruits of all of our other asset classes combined. Your health is wealth.

Health Insurance Products

We are a independent insurance brokerage, we represent all of the top carriers in any given market which means we are not forced to sell a particular carrier and can look out for the best interests of our clients.

So whether you’re looking for protection on your terms and you need coverage at a price you can afford for as long as you need, or looking for protection for a lifetime and want to build wealth to use while you are here and secure financial protection and build generational wealth for your family. We got you covered!

Short-Term Health Insurance

Short-term health plans are cheaper than traditional health insurance plans and are designed for short term periods. Examples are losing your job, age out of parents insurance, college student, retired but not Medicare age, self-employed, or just need temporary coverage. These plans can be purchased for 1 month up to 3 years depending on your state.

These insurance plans are Off-Exchange and are not sold on the Health Insurance Marketplace established under the Affordable Care Act (ACA). These plans are typically sold directly by insurance companies or through insurance brokers like RBI Capital Group.

Small Business Health Insurance

The future of employer sponsored health care is here. A new model of employee health insurance that is light on burdens for employers and heavy on benefits for employees. Stop doing employee benefits the hard way.

Medicare Insurance

Short-term health plans are cheaper than traditional health insurance plans and are designed for short term periods. Examples are losing your job, age out of parents insurance, college student, retired but not Medicare age, self-employed, or just need temporary coverage. These plans can be purchased for 1 month up to 3 years depending on your state.

These insurance plans are Off-Exchange and are not sold on the Health Insurance Marketplace established under the Affordable Care Act (ACA). These plans are typically sold directly by insurance companies or through insurance brokers like RBI Capital Group.

Dental

Dental plans can be purchased individually or as part of a health insurance plan. They typically have a network of dental providers that enrollees must use in order to receive coverage, although some plans may offer out-of-network coverage at a higher cost.

Vision

Vision plans can be purchased individually, combined with a Dental plan or as part of a health insurance plan. Vision plans typically have a network of eye care providers that enrollees must use in order to receive coverage, although some plans may offer out-of-network coverage at a higher cost.

Hearing

Hearing plans can be purchased individually or combined with a Dental and Vision plan or as part of a health insurance plan. These plans typically have a network of hearing care providers that enrollees must use in order to receive coverage, although some plans may offer out-of-network coverage at a higher cost.

ACA (Obama Care) Health Insurance

ACA (Affordable Care Act) plans, also known as Obama Care plans, are individual health insurance plans that are purchased through the Health Insurance Marketplace established under the Affordable Care Act. These plans must meet certain standards and provide essential health benefits, such as coverage for preventive services, hospitalization, prescription drugs, and maternity care.

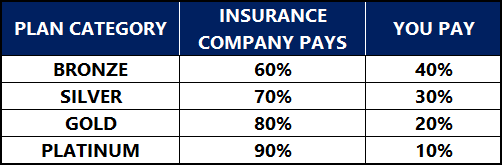

ACA plans are offered in different levels of coverage, such as bronze, silver, gold, and platinum, with each level providing different levels of cost-sharing. The amount of financial assistance an individual or family can receive to help pay for ACA plans is based on their income and household size.

Also, ACA plans cannot deny coverage based on pre-existing conditions, and they have a maximum out-of-pocket limit on cost-sharing expenses, such as deductibles and copayments.

- Lowest monthly premium

- Highest costs when you need care

- Bronze plan deductibles — the amount of medical costs you pay yourself before your insurance plan starts to pay — can be thousands of dollars a year.

- Good choice if: You want a low-cost way to protect yourself from worst-case medical scenarios, like serious sickness or injury. Your monthly premium will be low, but you’ll have to pay for most routine care yourself.

- Moderate monthly premium

- Moderate costs when you need care

- Silver deductibles — the costs you pay yourself before your plan pays anything — are usually lower than those of Bronze plans.

- Good choice if: You qualify for “extra savings” — or, if not, if you’re willing to pay a slightly higher monthly premium than Bronze to have more of your routine care covered.

- High monthly premium

- Low costs when you need care

- Deductibles — the amount of medical costs you pay yourself before your plan pays — are usually low.

- Good choice if: You’re willing to pay more each month to have more costs covered when you get medical treatment. If you use a lot of care, a Gold plan could be a good value.

- Highest monthly premium

- Lowest costs when you get care

- Deductibles are very low, meaning your plan starts paying its share earlier than for other categories of plans.

- Good choice if: You usually use a lot of care and are willing to pay a high monthly premium, knowing nearly all other costs will be covered.